Is It Wise to Take a Personal Loan for a Wedding? Pros and Cons

Weddings are a celebration of love and commitment, but they often come with a hefty price tag that can leave couples in financial turmoil. Among the various options available to finance a wedding, a personal loan stands out as a feasible alternative for many. But is taking a personal loan for a wedding truly wise? In this article, we delve into the pros and cons, exploring the primary keywords “personal loan for wedding” alongside secondary keywords like “2 lakh personal loan.”

Understanding the Cost of a Wedding

Before delving into the financial aspects, it’s essential to understand the average costs associated with weddings. Venue, catering, attire, and entertainment contribute to expenses that can quickly escalate. In India, weddings are often grand, traditional affairs that involve intricate planning and considerable spending.

Why Consider a Personal Loan for a Wedding?

A personal loan for wedding is a convenient way to manage the financial requirements without resorting to exhausting all your savings or relying on credit cards with high interest rates. Unlike traditional loans, personal loans are unsecured and don’t require collateral, making them accessible for many individuals. Flexibility in repayment terms and competitive interest rates can make this an attractive financing option.

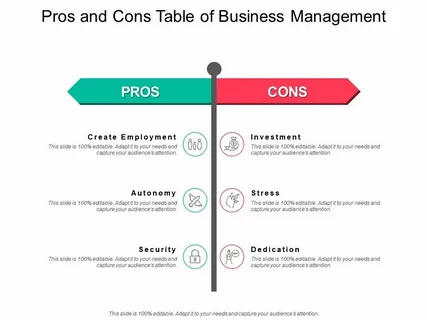

Pros of Taking a Personal Loan for a Wedding

1. Financial Flexibility

A personal loan offers financial flexibility, allowing you to plan a wedding without stringent budget constraints. You can allocate funds toward various aspects such as venue, catering, and attire, ensuring a memorable experience.

2. Fixed Monthly Payments

Personal loans come with fixed interest rates and monthly payments, making it easier to manage and predict your finances over time. This consistency helps avoid the uncertainty of fluctuating credit card interest rates.

3. Quick Approval Process

Compared to other financing methods, personal loans usually have a swift approval process, allowing couples to secure funds quickly and commence their planning without delays.

4. No Collateral Required

Obtaining a personal loan doesn’t necessitate pledging your assets as collateral. This unsecured nature of personal loans removes the risk of losing your property or valuable possessions.

Cons of Taking a Personal Loan for a Wedding

1. Indebtedness at the Start of Marriage

Starting married life with debt can exert pressure on the couple, potentially straining the relationship and redirecting focus from future financial goals such as buying a house or starting a family.

2. Impact on Credit Score

While diligent repayment can boost your credit score, any delay or default negatively affects it. Couples must be vigilant in managing their payments to avoid compromising their financial credibility.

3. Interest Payments Accumulate

Even with a competitive interest rate, the accumulated interest over the loan term can significantly increase the overall cost. It’s vital to comprehend the loan terms thoroughly and account for the total interest payments you’re committing to.

4. Adds Financial Burden

Taking out a loan means committing to repayments, which may impose an additional financial burden on your monthly budget. It’s crucial to evaluate your financial standing and determine whether your income can comfortably accommodate these extra payments.

Making the Decision: Is a 2 Lakh Personal Loan Suitable?

For those considering the feasibility of a “2 lakh personal loan” for wedding expenses, several crucial factors can aid in decision-making. Estimating your total costs, current financial standing, and future financial plans is critical. If the projected wedding expenses align well with your earnings and you can manage consistent repayments, opting for a loan might prove advantageous. Conversely, if the loan threatens your financial stability, consider reevaluating your wedding budget or exploring alternative financing methods.

Conclusion

Taking a personal loan for a wedding is a significant financial decision that requires thorough contemplation. While there are undeniable advantages such as flexibility and no need for collateral, the potential downsides, including the burden of debt, interest accumulation, and impact on financial future, must be carefully weighed. A “2 lakh personal loan” can indeed help achieve your dream wedding, but it’s vital to ensure that you are financially capable of handling the repayment and not compromising your long-term goals.

Ultimately, the decision lies in balancing desires with financial prudence. Discuss with your partner, budget meticulously, and perhaps seek guidance from a financial advisor to make a sound decision that ensures both a memorable wedding experience and a stable financial future.