How Real-Time Data Integration Accelerates Financial Modeling?

Financial markets respond within seconds. Earnings releases, forecast upgrades, or economic news can alter valuations and investment plans in an instant. Access to stale data is never acceptable. Financial modeling needs real-time data integration for financial analysts, asset managers, as well as financial professionals to speed up, improve accuracy, and enhance effectiveness.

Why Speed Matters in Financial Modeling?

Financial modeling supports investment decisions by evaluating firms, sectors as well as markets and forecasting performance and risk. Models are only as good as the data being computed. Lagging data do not accurately represent existing market dynamics, resulting in lost opportunities, distorted valuations, and misguided risk assessments. Real-time updates transform static models into dynamic frameworks that respond in real time to market changes.

Role of Data Integration

Real-time financial modeling relies on the smooth integration of various data sources—such as earnings reports, analyst estimates, and macroeconomic indicators—onto a single, trustworthy platform. In the absence of integration, experts waste time in manually reconciling data, leading to errors and slowing analysis.

Strong integration guarantees

- Automated model updates with the latest earnings

- Consistent, validated data

- Quick and reliable decision-making

Closing the Gap Between Actuals and Forecasts

Reconciling past performance with future projections is a key challenge in modeling. Markets reward foresight, but forecasts must remain aligned with actuals finance. Real-time integration accelerates this reconciliation:

- Quarterly results update models immediately

- Forecasts recalibrate automatically based on the latest data

- Analysts focus on strategy and insights instead of manual updates

This agility allows organizations to react within hours vs. days to market changes, providing a competitive edge.

Benefits of Real-Time Financial Modeling

The implementation of real-time integration provides long-term value through:

- Efficiency – Minimizes manual updates and eliminates human error

- Accuracy – Aligns forecasts with confirmed financial data

- Collaboration – Provides worldwide teams with accurate numbers to work from

- Agility – Allows swift changes to investment strategies as circumstances evolve

In a world of fast-cjhanging market cycles and fierce competition, these benefits directly impact portfolio performance.

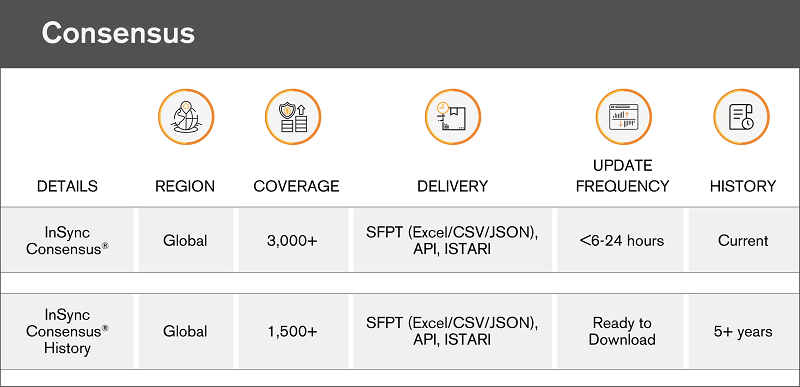

InSync Analytics – Enabling Real-Time Integration

InSync Analytics assists financial professionals with solutions that merge AI-powered tools, proprietary platforms, and seasoned analyst teams. The company offers

- Certified, real-time data

- Consensus estimates and historical accounting data

- Pre-built models and customized analyst assistance

With more than 18 years of experience, InSync assists clients with accurate, current models, enhancing efficiency, lowering costs and allowing for more accurate investment decisions.

Conclusion

Financial modeling right now demands more than strong fundamentals; it needs constant, accurate refreshes. Integrating real-time data keeps models connected to evolving market conditions, closing the gap between past performance and future outlook. This ensures accuracy, responsiveness, and enhances decision-making in fluid markets.

Firms such as InSync Analytics provide the technology and expertise to automate this process to allow companies to bring financial modeling into the twenty-first century and enhance investment results.